UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| |

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| | |

☐ | | Preliminary Proxy Statement |

|

|

☐ | | Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) |

|

|

☒ | | Definitive Proxy Statement |

|

|

☐ | | Definitive Additional Materials |

|

|

☐ | | Soliciting Material Pursuant to §240.14a-12 |

Teradyne, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| | | | |

☒ | |

☒ | | No fee required. |

| |

☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) |

| Aggregate number of securities to which transaction applies:

|

| | (3) | ☐ | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

| |

☐ | | Fee paid previously with preliminary materials. |

| |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid:

materials |

| | (2) |

| Form, Schedule or Registration Statement No.:

|

| | (3) | ☐ | Filing Party:

|

| | (4) | | Date Filed:

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TERADYNE, INC.

600 Riverpark Drive

North Reading, Massachusetts 01864

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS:

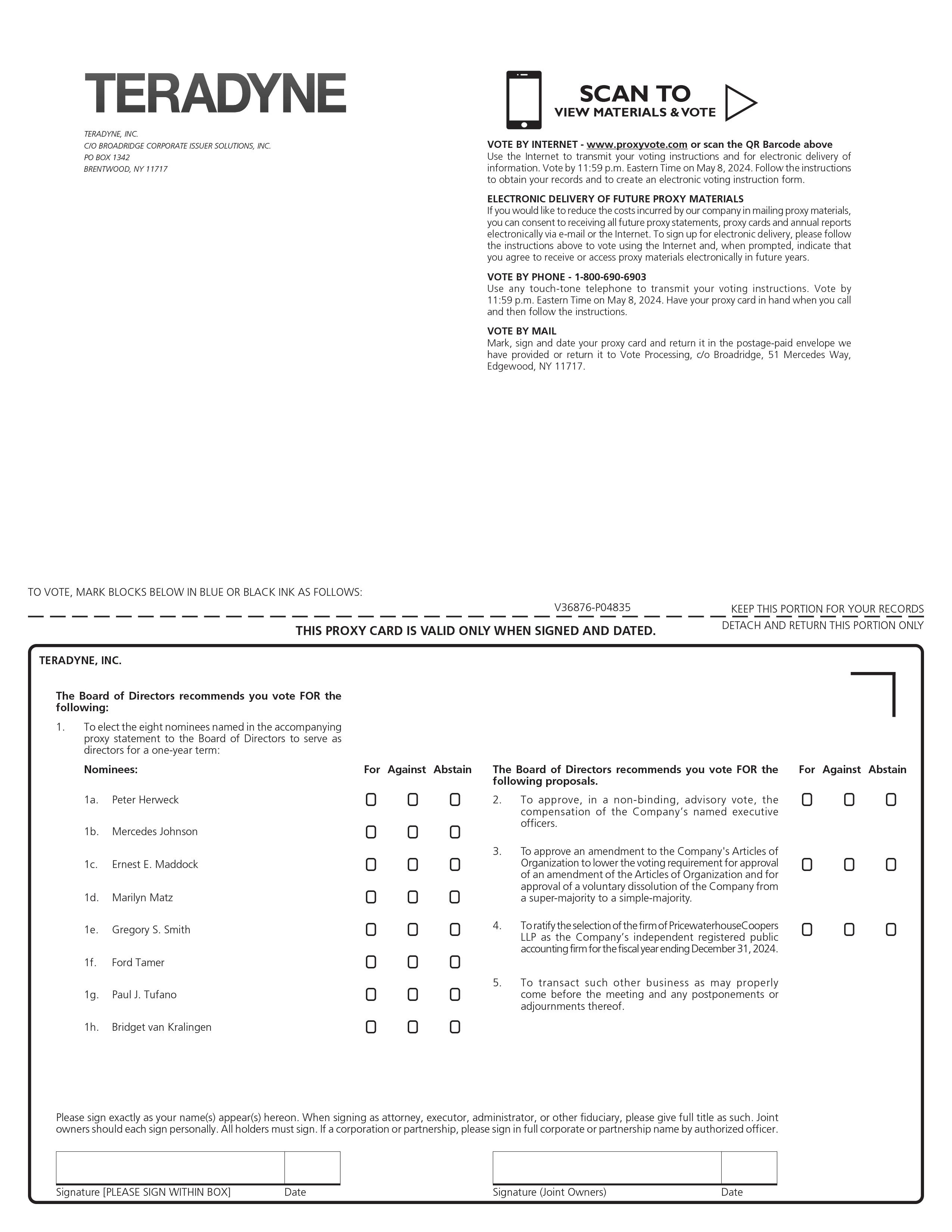

The Annual Meeting of Shareholders of Teradyne, Inc., a Massachusetts corporation, will be held on Tuesday,Thursday, May 8, 20189, 2024 at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864 (the “Annual Meeting”), for the following purposes:

1. To elect the eight nominees named in the accompanying proxy statement to the Board of Directors to serve as directors for a one-year term.term;

2. To approve, inon a non-binding, advisory vote,basis, the compensation of the Company’s named executive officers.officers;

3. To approve an amendment to the Company’s Articles of Organization to lower the voting requirement for approval of an amendment of the Articles of Organization and for approval of a voluntary dissolution of the Company from a super-majority to a simple-majority;

4. To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018.2024; and

4.5. To transact such other business as may properly come before the meeting and any postponements or adjournments thereof.

Shareholders entitled to notice of and to vote at the meetingAnnual Meeting shall be determined as of the close of business on March 15, 2018,14, 2024, the record date fixed by the Board of Directors for such purpose.

By Order of the Board of Directors,

Charles J. Gray, Secretary

March 29, 20182024

Shareholders are requested to vote in one of the following three ways: (1) by completing, signing and dating the proxy card provided by Teradyne and returning it by return mail to Teradyne in the enclosed envelope or at the address indicated on the proxy card, (2) by completing a proxy using the toll-free telephone number listed on the proxy card, or (3) by completing a proxy on the Internet at the address listed on the proxy card.

Table of Contents

TERADYNE, INC.

600 Riverpark Drive

North Reading, Massachusetts 01864

PROXY STATEMENT

March 29, 20182024

Proxies in the form provided by Teradyne, Inc. (“Teradyne” or the “Company”) are solicited by the Board of Directors (“Board”) of Teradyne for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday,Thursday, May 8, 2018,9, 2024, at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864.

Only shareholders of record as of the close of business on March 15, 201814, 2024 (the “Record Date”) will be entitled to vote at this annual meetingthe Annual Meeting and any adjournments thereof. As of the Record Date, 194,727,132152,973,620 shares of common stock were issued and outstanding. Each share outstanding as of the Record Date will be entitled to one vote, and shareholders may vote in person or by proxy. Delivery of a proxy will not in any way affect a shareholder’s right to attend the annual meetingAnnual Meeting and vote in person. Any shareholder delivering a proxy has the right to revoke it only by written notice to the Secretary or Assistant Secretary delivered at any time before it is exercised, including at the annual meeting.Annual Meeting. All properly completed proxy forms returned in time to be cast at the annual meetingAnnual Meeting will be voted. Shareholders attending the Annual Meeting will be provided an opportunity to ask questions of the Board and management, including the Company appointed proxies, Gregory S. Smith, Ryan E. Driscoll, and Gregory W. McIntosh.

Important Notice Regarding the Availability of Proxy Materials for

the ShareholderThe Annual Meeting to be Held on May 8, 20189, 2024

This Proxy Statement and the Accompanying Annual Report on Form 10-K, Letter to Shareholders, and Notice, are available atwww.proxyvote.com

At the meeting,Annual Meeting, the shareholders will consider and vote upon the following proposals put forth by the Board:

1.To elect the eight nominees named in this proxy statement to the Board of Directors to serve as directors for a one-year

term.term;

2.To approve,

inon a non-binding, advisory

vote,basis, the compensation of the Company’s named executive

officers.officers;

3.To approve an amendment to the Company’s Articles of Organization to lower the voting requirement for approval of an amendment of the Articles of Organization and for approval of a voluntary dissolution of the Company from a super-majority to a simple-majority; and

4.To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018.2024.

The Board recommends that you voteFOR the proposals listed above.

5.Shareholders will also consider any other business properly brought before the Annual Meeting or any adjournment.

On or about March 29, 2018,2024, the Company mailed to its shareholders of record as of March 15, 201814, 2024, a notice containing instructions on how to access this proxy statement and the Company’s annual report online and to vote. Also on March 29, 2018,2024, the Company began mailing printed copies of these proxy materials to shareholders that have requested printed copies.

If you received a notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your

proxy overon the Internet.website listed on the proxy card and notice. If you received a notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions for requesting such materials included in the notice.

If a shareholder completes and submits a proxy, the shares represented by the proxy will be voted in accordance with the instructions for such proxy. If a shareholder submits a proxy card but does not fill out the voting instructions, shares represented by such proxy will be voted FOR each of the proposals listed above.

Shareholders may vote by proxy in one of the following three ways:

1.by completing a proxy on the

Internet at the addresswebsite listed on the proxy card or notice,

2.by completing a proxy using the toll-free telephone number listed on the proxy card or notice, or

3.by completing, signing and dating the proxy card provided by Teradyne and returning it in the enclosed envelope or by return mail to Teradyne at the address indicated on the proxy card.

If you attend the Annual Meeting, you may vote in person even if you have previously returned your vote in accordance with one of the foregoing methods.

A majority of the outstanding shares represented at the meetingAnnual Meeting in person or by proxy shall constitute a quorum for the transaction of business. Abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for the meeting. A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Brokers who hold shares on your behalf have discretionary authority to vote shares if specific instructions are not given with respect to routine matters. Although the determination of whether a nominee will have discretionary voting power for a particular item is typically determined only after proxy materials are filed with the SEC, we expect that Proposal Nos. 1, 2, and 3 will be non-routine matters and that Proposal No. 4 will be a routine matter. Accordingly, if your shares are held by a broker on your behalf and you do not instruct the broker as to how to vote your shares, your broker would not be entitled to exercise discretion to vote your shares on Proposal Nos. 1, 2, and 3. For this annual meeting, on all matters being submitted to shareholders,Annual Meeting, an affirmative vote of at least a majority of the shares voting on the matter at the meeting is required for approval.approval of Proposal Nos. 1, 2, and 4 and an affirmative vote of at least two-thirds of the shares outstanding and entitled to vote on the matter is required for approval of Proposal No. 3. Abstentions and broker “non-votes” are included in the number of shares present, or represented, at the Annual Meeting, but are not included in the number of shares voting at the Annual Meeting on non-routine matters. The vote on each matter submitted to shareholders is tabulated separately. Abstentions are not included in the number of shares present, or represented, and voting on each separate matter. Broker “non-votes” are also not included. An automated system administered by Teradyne’s transfer agent tabulates the votes.

The Board knows of no other mattermatters to be presented at the annual meeting.Annual Meeting. If any other matter should be presented at the annual meetingAnnual Meeting upon which a vote properly may be taken, shares represented by all proxies received by the Board will be voted in accordance with the judgment of those officers named as proxies and in accordance with the Securities and Exchange Commission’s (“SEC’s”) proxy rules. See the section entitled “Shareholder Proposals for 20192025 Annual Meeting of Shareholders” for additional information.

The Board presently consists of nine members, eight of whom are independent directors. Each director is elected annually for a one-year term. Ms. Matz joined the Board effective July 3, 2017. The current terms of the directors expire at the 2018 Annual Meeting of Shareholders.Meeting. The Board, based on the recommendation of the Nominating and Corporate Governance Committee, has nominated all current directors for re-election, other than Mr. ChristmanGuertin, who is retiring from the Board effective upon the conclusion of the 2018 Annual Meeting of Shareholders.Meeting. Teradyne has no reason to believe that any of the nominees will be unable to serve; however, if that should be the case, proxies will be voted for the election of some other person (nominated in accordance with Teradyne’s bylaws) or the Board will decrease the number of directors that currently serve on the Board. If elected, each director will hold office until the 20192025 Annual Meeting of Shareholders.

The Board recommends a vote FOR the election to the Board each of Mses. Johnson, Matz and Matzvan Kralingen and each of Messrs. Bradley, Gillis, Guertin, Jagiela, TufanoHerweck, Maddock, Smith, Tamer, and Vallee.Tufano.

The following table sets forth the nominees to be elected at this annual meeting,the Annual Meeting, the year each person was first appointed or elected, the principal occupation of that person during at least the past five years, that person’s age, any other public company boards on which the nominee serves or has served in the past five years, and the nominee’s qualifications to serve on the Board. In addition to the information presented below regarding each

nominee’s specific experience, background, qualifications, attributes and skills that led the Board to the conclusion that he or shethey should serve as a director, Teradyne also believes that all of its director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Teradyne and the Board. Additionally, Teradyne values the directors’ diversity and significant experience on other public company boards of directors and board committees.

Nominees for Directors

| | | | | | |

Name | | Year

Became

Director | |

| Year Became Director |

| Background and Qualifications |

Michael A. BradleyPeter Herweck

Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Robotics Industry ✔ M&A ✔ Sales & Marketing ✔ Technical Product Development ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight ✔ Cybersecurity and Information Security ✔ Climate-related Risk

| | | 2004 | |

| Mr. Bradley, 69, served as the Company’s Chief Executive Officer from May 2004 until February 2014. He was President of Teradyne from May 2003 until January 2013, President of the Semiconductor Test Division from April 2001 until May 2003 and Chief Financial Officer from July 1999 until April 2001. From 1992 until 2001, he held various Vice President positions at Teradyne. Mr. Bradley has been a director of Entegris, Inc., and its predecessor company Mykrolis Corporation, since 2001 and of Avnet, Inc. since November 2012.

Mr. Bradley contributes valuable institutional knowledge and executive experience from his 39 years with Teradyne, including 10 years as Chief Executive Officer.

|

| | |

Edwin J. Gillis2020

| | | 2006 | |

| Mr. Gillis, 69,Herweck, 57, has worked as a business consultant and private investor since January 2006. From July 2005 to December 2005, he was the Senior Vice President of Administration and Integration of Symantec Corporation, following the merger of Veritas Software Corporation and Symantec Corporation. He served as Executive Vice President and Chief Financial Officer of Veritas Software Corporation from November 2002 to June 2005, as the Executive Vice President and Chief Financial Officer of Parametric Technology Corporation from September 1995 to November 2002, and as the Chief Financial Officer of Lotus Development Corporation from 1991 to September 1995. Prior to joining Lotus, Mr. Gillis was a Certified Public Accountant and partner at Coopers & Lybrand L.L.P. Mr. Gillis has been a director of LogMeIn, Inc. since November 2007 and a director of Sophos Plc. since November 2009. Mr. Gillis was a director of Responsys Inc. from March 2011 to January 2014. Mr. Gillis contributes extensive experience relating to the issues confronting global technology companies and financial reporting expertise as a former Chief Financial Officer of several publicly-traded technology companies.

|

| | | | | | |

Name

| | Year

Became

Director | | | Background and Qualifications

|

| | |

Timothy E. Guertin

| | | 2011 | | | Mr. Guertin, 68, has been the Vice Chairman of the Board of Directors of Varian Medical Systems, Inc. (“Varian”) since September 2012 and a director of Varian since 2005. He served as Chief Executive Officer of Varian from February 2006Schneider Electric since May 2023. Prior to September 2012 andserving as President from August 2005 to September 2012. HeSchneider Electric’s Chief Executive Officer, Mr. Herweck served as Chief OperatingExecutive Officer of the AVEVA Group plc from October 2004May 2021 to February 2006 andMarch 2023. Prior to AVEVA Group, Mr. Herweck served as Corporate Executive Vice President of Schneider Electric’s global Industrial Automation business and on Schneider Electric’s Executive Committee from October 20022016 to August 2006. Prior to that time, he was President of Varian’s Oncology Systems business unit from 1992 to January 2005 and a Corporate Vice President from 1992 to 2002.

April 2021. Mr. Guertin contributes significant executive experience at a global technology and manufacturing company with issues similar to those confronting Teradyne. |

| | |

Mark E. Jagiela

| | | 2014 | | | Mr. Jagiela, 57,Herweck has served asbeen a director and as the Company’s Chief Executive Officer since February 2014. He has served as the President of Teradyne since January 2013 and the President of the Company’s Semiconductor Test DivisionAVEVA Group plc from 2003 to February 2016. March 2018 until January 2023 when it was taken private.

Mr. Jagiela was appointed a Vice President of Teradyne in 2001. He has held a variety of senior management roles at the Company including General Manager of Teradyne’s Japan Division. Mr. JagielaHerweck contributes valuable executive experience from his 36 years in multiple management roles, includingwithin the global industrial automation industry as President and Chief Executive Officer, within Teradyne.well as extensive knowledge of the issues affecting complex industrial automation companies.

|

| | |

Mercedes Johnson Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Semiconductor and Electronics Industry ✔ M&A ✔ Financial | | | 2014 | |

| 2014 |

| Ms. Johnson, 64,70, served as Interim Chief Financial Officer of Intersil Corporation from April 2013 to September 2013 and as the Senior Vice President and Chief Financial Officer of Avago Technologies Limited from December 2005 to August 2008. Prior to joining Avago, Ms. Johnson was Senior Vice President, Finance, of Lam Research Corporation from June 2004 to January 2005 and Chief Financial Officer of Lam from May 1997 to May 2004. Ms. Johnson has been a director of Micron Technology,Synopsys, Inc. since June 2005, a director of Juniper Networks, Inc. since May 2011,February 2017, and a director of Synopsys,Analog Devices, Inc. since February 2017.August 2021. Ms. Johnson was a |

| | | | |

Name |

| Year Became Director |

| Background and Qualifications |

✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight

|

|

|

| director of Intersil Corporation from August 2005 to February 2017.2017, a director of Micron Technology, Inc. from June 2005 to January 2019, a director of Juniper Networks, Inc. from May 2011 to May 2019, a director of Maxim Integrated Products from September 2019 until its acquisition by Analog Devices, Inc. in August 2021, and a director of Millicom International Cellular S.A. from May 2019 to May 2023. Ms. Johnson contributes valuable industry and operational experience as a former senior financial executive at semiconductor and semiconductor equipment companies as well as a current member of the boards of directors of global technology companies. |

| | | | | | |

NameErnest E. Maddock

Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Semiconductor and Electronics Industry ✔ M&A ✔ Technical Product Development ✔ Financial ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight

| | Year

Became

Director | |

| Background2022

|

| Mr. Maddock, 65, served as Senior Vice President and QualificationsChief Financial Officer of Micron Technology, Inc. from 2015 until his retirement in 2018. Prior to that, he served as Executive Vice President and Chief Financial Officer of Riverbed Technology, Inc. from 2013 to 2015. From 1997 to 2013, Mr. Maddock served in various roles at Lam Research Corporation, culminating in the position of Chief Financial Officer from 2008 to 2013. Mr. Maddock has served on the boards of directors of Ultra Clean Holdings Inc. since June 2018, Avnet since August 2021, and Ouster, Inc. (successor following merger with Velodyne Lidar, Inc). since January 2022. Mr. Maddock previously served on the Board of Intersil Corporation from 2015 until its acquisition in 2017. Mr. Maddock contributes over 35 years of experience in the technology industry serving in operations, technology and finance roles including 10 years as a public company Chief Financial Officer. |

| | |

Marilyn Matz Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Robotics Industry ✔ Sales & Marketing ✔ Technical Product Development ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight ✔ Cybersecurity and Information Security | | | 2017 | |

| 2017 |

| Ms. Matz, 64,70, is a co-founder of Paradigm4, Inc. and has served as its Chief Executive Officer and Chair of the Board of Directors since December 2009. Previously, Ms. Matz was a co-founder of Cognex Corporation where she held a variety of leadership positions in engineering and business operations from March 1981 to December 2008 including her final role as Senior Vice President and Business Unit Manager of its PC Vision Products Group. Ms. Matz served on the Board of Directors for LogMeIn, Inc. from September 2014 to February 2017. Ms. Matz contributes valuable technical expertise and leadership experience from more than 3640 years in automation, machine vision and software analytics related industries. |

Gregory S. Smith Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Semiconductor and Electronics Industry ✔ Robotics Industry ✔ M&A ✔ Sales & Marketing ✔ Technical Product Development ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight |

| 2023 |

| Mr. Smith, 61, is the President and Chief Executive Officer of Teradyne. Mr. Smith was the President of Robotics at Teradyne from October 2020 through July 2023. Prior to leading Robotics, Mr. Smith was the President of the Semiconductor Test Business, Teradyne’s largest operating segment, from February 2016 to October 2020. Mr. Smith began his career at Raytheon as a test engineer and held numerous engineering and management roles in the semiconductor test industry before joining Teradyne in 2006. Mr. Smith contributes valuable executive experience from his 18 years in multiple management roles, including as President and Chief Executive Officer, within Teradyne. |

| | | | |

Name |

| Year Became Director |

| Background and Qualifications |

Ford Tamer Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Semiconductor and Electronics Industry ✔ M&A ✔ Sales & Marketing ✔ Technical Product Development ✔ Financial ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight ✔ Cybersecurity and Information Security ✔ Climate-related Risk |

| 2021 |

| Mr. Tamer, 62, has served as Senior Operating Partner at Francisco Partners since October 2022. Prior to this role, Mr. Tamer served as Chief Executive Officer of Inphi Corporation from February 2012 until April 2021. Mr. Tamer served as President and Chief Executive Officer of Telegent Systems from 2010 to 2012. Prior to that time, he served as a partner of Khosla Ventures from 2007 to 2010 and Senior Vice President and General Manager of Broadcom’s Infrastructure Networking from 2002 to 2007. Mr. Tamer also was the co-founder and Chief Executive Officer of Agere, Inc., which was acquired by Lucent Microelectronics. Mr. Tamer has been a director of Marvell Technology, Inc. since April 2021. Mr. Tamer was director of Inphi Corporation from February 2012 until its acquisition by Marvell Technology, Inc. in April 2021. Mr. Tamer contributes significant executive and operational experience at global semiconductor companies as well as extensive knowledge of the issues affecting Teradyne’s customers and suppliers. |

Paul J. Tufano Qualifications/Skills ✔ C-Level ✔ Global Business ✔ Semiconductor and Electronics Industry ✔ M&A ✔ Financial ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight | | | 2005 | |

| 2005 |

| Mr. Tufano, 64, has70, served as President and Chief Executive Officer of Benchmark Electronics, Inc. sincefrom September 2016. He2016 to March 2019. Mr. Tufano served as the Chief Financial Officer of Alcatel-Lucent from December 2008 to September 2013 and Chief Operating Officer of Alcatel-Lucent from January 2013 to September 2013. He was Executive Vice President of Alcatel-Lucent from December 2008 to January 2013. He also served as a consultant for Alcatel-Lucent from September 2013 to April 2014. Mr. Tufano was the Executive Vice President and Chief Financial Officer of Solectron Corporation from January 2006 to October 2007 and Interim Chief Executive Officer from February 2007 to October 2007. Prior to joining Solectron, Mr. Tufano worked at Maxtor Corporation where he was President and Chief Executive Officer from February 2003 to November 2004, Executive Vice President and Chief Operating Officer from April 2001 to February 2003 and Chief Financial Officer from July 1996 to February 2003. From 1979 until he joined Maxtor Corporation in 1996, Mr. Tufano held a variety of management positions in finance and operations at International Business Machines Corporation. Mr. Tufano has been a director of EnerSys since April 2015 and2015. Mr. Tufano served on the Board of Directors of Benchmark Electronics, Inc. sincefrom February 2016.2016 to March 2019. Mr. Tufano contributes widespread knowledge of the issues confronting complex technology and manufacturing companies and extensive financial reporting and operational expertise. |

| | |

Roy A. ValleeBridget van Kralingen

Qualifications/Skills ✔ C-Level ✔ Global Business ✔ M&A ✔ Sales & Marketing ✔ Technical Product Development ✔ Financial ✔ Legal/Regulatory Compliance and Risk Oversight ✔ ESG Oversight ✔ Cybersecurity and Information Security | | | 2000 | |

| Mr. Vallee, 65,2024

|

| Ms. van Kralingen, 60, has been a Partner at Motive Partners since November 2022. Prior to Motive Partners, she served in various leadership positions at IBM Corporation from April 2004 through December 2021, including most recently leading IBM's Global Sales and Markets Division. Before joining IBM in 2004, Ms. van Kralingen served as Executive Chairman of the Board of Directors of Avnet, Inc. from July 2011 to November 2012 and as a director of Avnet, Inc. from 1991 to 2012. From July 1998 to July 2011, he was Chairman of the Board of Directors and Chief Executive Officer of Avnet, Inc. He also was Vice Chairman of the Board of Directors from November 1992 to July 1998 and President and Chief Operating Officer from March 1992 until July 1998. Since 2003, Mr. ValleeManaging Partner, US Financial Services with Deloitte Consulting. Ms. van Kralingen has been a director of Synopsys, Inc.Royal Bank of Canada since June 2011, a director of Travelers Insurance since January 2022, and currently servesa director of Discovery Limited since June 2022. Ms. van Kralingen contributes extensive global business experience as lead independent director. He is a former Chairmanexecutive of the Board of Directors of the Federal Reserve Bank of San Francisco. Mr. Vallee contributes valuable executive experience within thea global technology industry as well as extensive knowledge of the issues affecting complexcompany and has significant expertise in information technology companies.services, international operations, and global sales and business development.

|

Director Qualifications and Experience

As described above, each Director nominee brings a diversity of skills and experiences to the Board that are complementary and, together, cover the spectrum of areas that impact the Company’s current and evolving business. A summary of each nominee's qualifications and experience is set forth in the Qualifications/Skills matrix below. As the matrix is a summary, it does not include all the skills, experience, qualifications and diversity that each nominee offers, and the fact that a particular experience, skill or qualification is not listed does not mean that a nominee does not possess it. Additionally, the Board is committed to the pursuit of board refreshment and balanced tenure. The matrix also shows the tenure of each director nominee. The Board believes that the combination of backgrounds, skills and experience has resulted in a Board that is well-equipped to exercise oversight responsibilities on behalf of the Company’s stakeholders.

| | | | | | | | | | | | | | | | | |

Qualifications/Skills | | Herweck | | Johnson | | Maddock | | Matz | | Smith | | Tamer | | Tufano | | van Kralingen | |

C-Level Experience | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | |

Global Business Experience | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | |

Semiconductor and Electronics Industry Experience | | | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | | |

Robotics Industry Experience | | ✓ | | | | | | ✓ | | ✓ | | | | | | | |

M&A Experience | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | |

Sales/Marketing Experience | | ✓ | | | | | | ✓ | | ✓ | | ✓ | | | | ✓ | |

Technical Product Development Expertise | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | |

Financial Expertise | | | | ✓ | | ✓ | | | | | | ✓ | | ✓ | | ✓ | |

Legal/Regulatory Compliance and Risk Oversight | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | |

ESG Oversight | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | |

Cybersecurity and Information Security | | ✓ | | | | | | ✓ | | | | ✓ | | | | ✓ | |

Climate-related Risk Experience (1) | | ✓ | | | | | | | | | | ✓ | | | | | |

Tenure (Years) | | 4 | | 10 | | 2 | | 7 | | 2 | | 3 | | 19 | | 1 | |

(1)In Mr. Herweck’s capacity as CEO of AVEVA Group, he expanded his climate-related risk experience and participates in the First Movers Coalition of the World Economic Forum and the CEO Alliance for Climate Actions of the World Economic Forum. While at Khosla Ventures, Mr. Tamer spent three years studying climate change and related technologies, such as emissions, solar, engines, batteries, LED, and motors.

Board Diversity Matrix (as of March 29, 2024)

The Board values racial, ethnic, cultural, and gender diversity in evaluating new candidates and seeks to incorporate a wide range of those attributes in Teradyne’s Board of Directors. The following matrix is provided in accordance with applicable Nasdaq listing requirements and includes all directors as of March 29, 2024.

| | | | | | | | | | | | | | | | | |

Total Number of Directors | | 9* | |

| | Female | | | Male | | | | Non-Binary | | | Did Not

Disclose

Gender | |

Part I: Gender Identity | | | | | | | | | | | | | |

Directors | | | 3 | | | | 6 | | * | | | — | | | | — | |

Part II: Demographic Background | | | | | | | | | | | | | |

African American or Black | | | — | | | | — | | | | | — | | | | — | |

Alaskan Native or Native American | | | — | | | | — | | | | | — | | | | — | |

Asian | | | — | | | | — | | | | | — | | | | — | |

Hispanic or Latinx | | | 1 | | | | — | | | | | — | | | | — | |

Native Hawaiian or Pacific Islander | | | — | | | | — | | | | | — | | | | — | |

White | | | 2 | | | | 6 | | * | | | — | | | | — | |

Two or More Races or Ethnicities | | | — | | | | — | | | | | — | | | | — | |

LGBTQ+ | | | | | | 1 | | | | | | | | |

Demographic Background Undisclosed | | | | | | — | | | | | | | | |

* Includes Mr. Guertin who is retiring from the Board effective upon the conclusion of the Annual Meeting.

The following matrix provides diversity information regarding the individual members of the Company’s Board which have been nominated for re-election at the Annual Meeting:

| | | | | | | | | | | | | | | | | |

|

| Herweck |

| Johnson |

| Maddock |

| Matz |

| Smith |

| Tamer |

| Tufano |

| van Kralingen |

|

Demographics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Race/Ethnicity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

African American |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asian/Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

White/Caucasian |

| ✓ |

|

|

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

|

Hispanic/Latinx |

|

|

| ✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Native American |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Undisclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

| ✓ |

|

|

| ✓ |

|

|

| ✓ |

| ✓ |

| ✓ |

|

|

|

Female |

|

|

| ✓ |

|

|

| ✓ |

|

|

|

|

|

|

| ✓ |

|

Non-Binary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Undisclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sexual Orientation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LGBTQ+ |

|

|

|

|

| ✓ |

|

|

|

|

|

|

|

|

|

|

|

Undisclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL NO. 2

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Company is providing shareholders with the opportunity at the 2018 Annual Meeting to vote on the following advisory resolution, commonly known as “Say-on-Pay”:

RESOLVED, that the shareholders of the Company approve, in a non-binding, advisory vote, the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement under the headings “Compensation Discussion and Analysis” and “Executive Compensation Tables” pursuant to Item 402 of Regulation S-K.

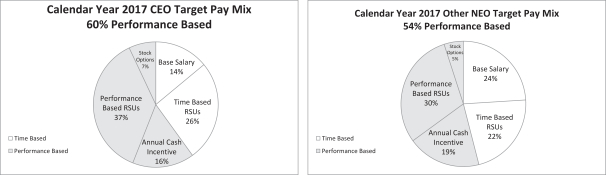

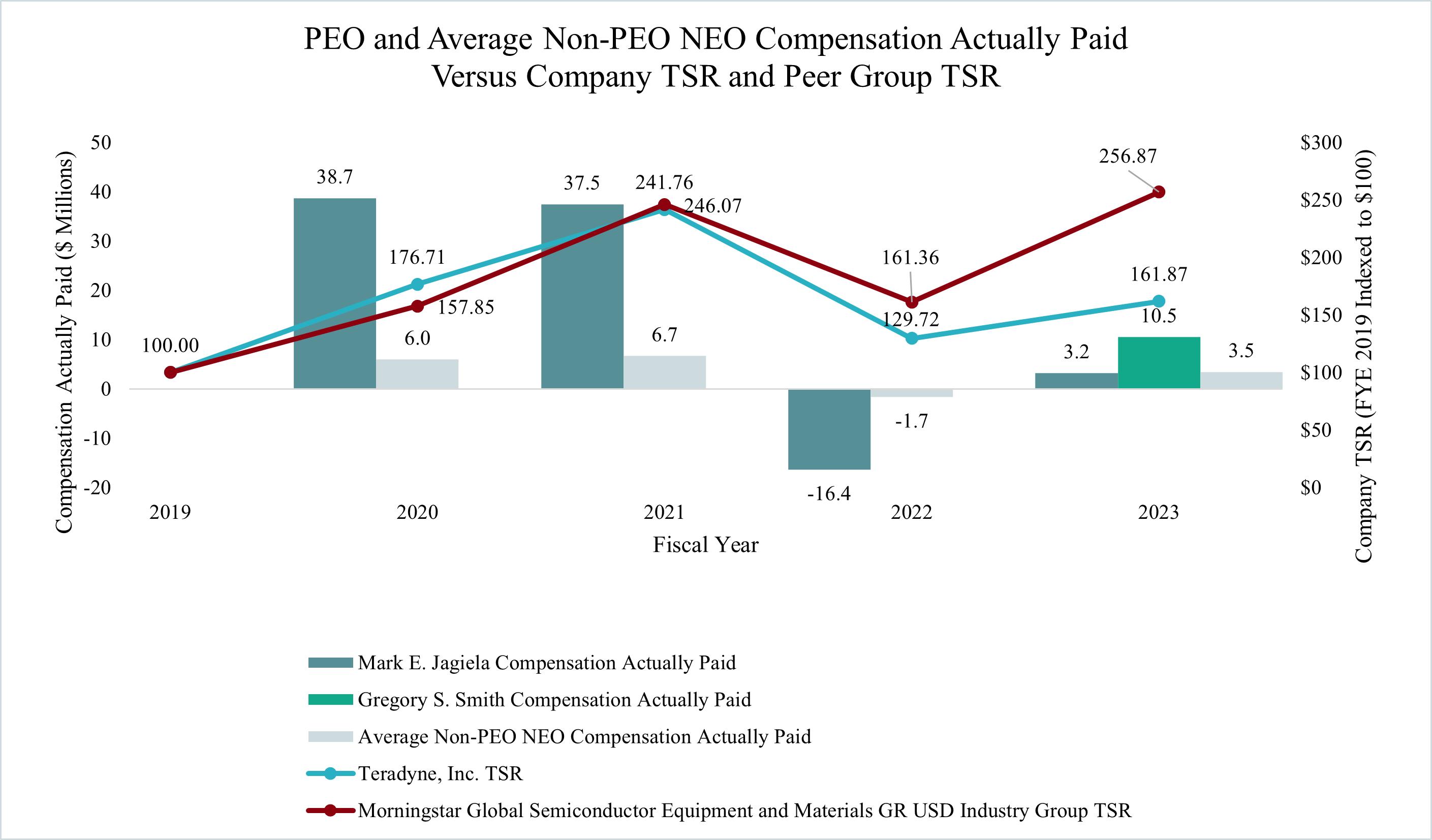

The Company’s Board of DirectorsCompensation Committee has implemented an executive compensation program that rewards performance. The Board of DirectorsCompensation Committee fosters a performance-oriented environment by tying a significant portion of each executive officer’s cash and equity compensation to the achievement of short-term and long-term performance objectives that are important to the Company and its shareholders. The Board of DirectorsCompensation Committee has designed the Company’s executive compensation program to attract, motivate, reward and retain the senior management talent required to achieve the Company’s corporate objectives and increase shareholder value. The Company believes that its compensation policies and practices reflect a pay-for-performance philosophy and are strongly aligned with the long-term interests of shareholders. The Company recommends shareholders read the sections of this proxy statement entitled “Compensation Discussion and Analysis” and “Executive Compensation Tables” before voting on this “Say-on-Pay” advisory proposal.

The performance-based executive compensation program resulted in compensation for the Company’s named executive officers that reflects the Company’s challenging performance goals for 2017 and performance in achieving those goals. The Company increased revenues by 22% to $2.14 billion, generated significant free cash flow and increased its profit rate before interest and taxes, or PBIT, as described in the section of this proxy statement entitled “Compensation Discussion and Analysis”. The Company achieved market share gains in its semiconductor test business, achieved model profitability in its wireless test business and grew its industrial automation business by over 70% year over year. Additionally, in 2017, the Company exceeded its 2020 earnings per share target three years ahead of plan.

The Company’s sustained profitability and free cash flow allowed the Company in 2017 to return $256 million to shareholders through payment of quarterly dividends and share repurchases. The Company has announced a new $1.5 billion share repurchase authorization and plans to repurchase $750 million of shares in 2018 and has announced a 29% increase to its quarterly dividend to $0.09 per share.

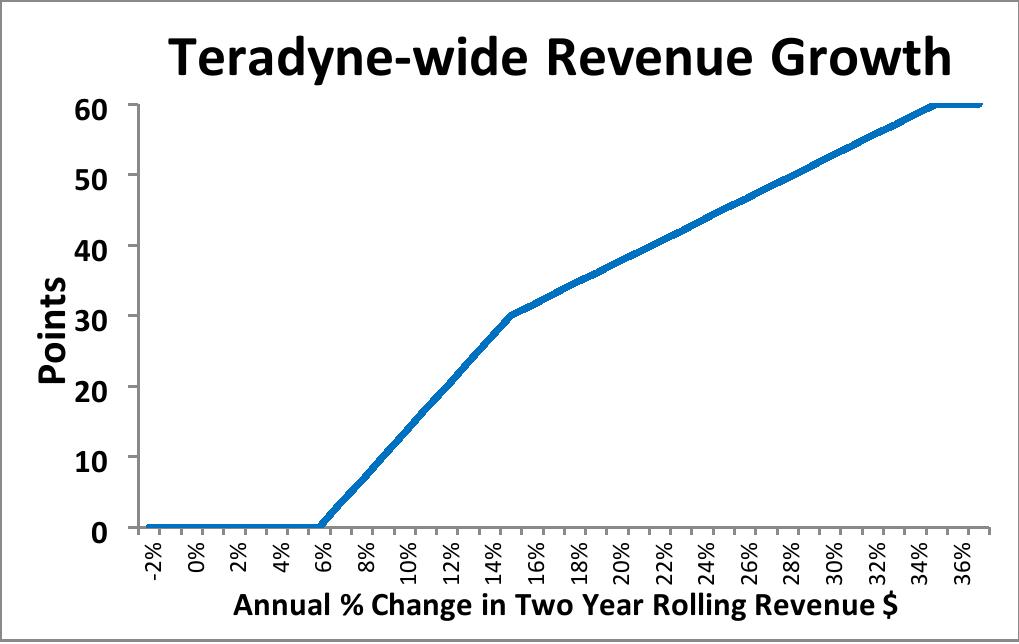

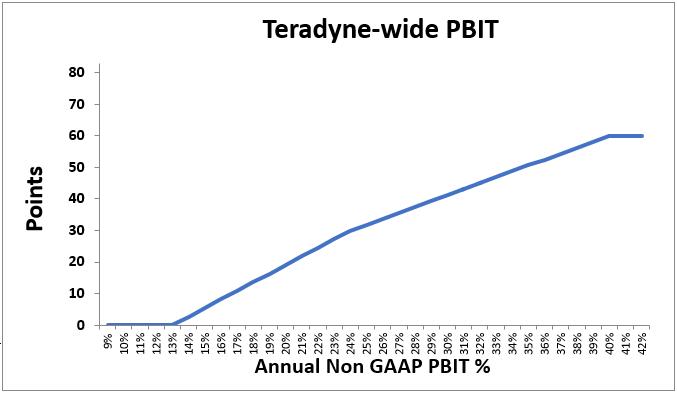

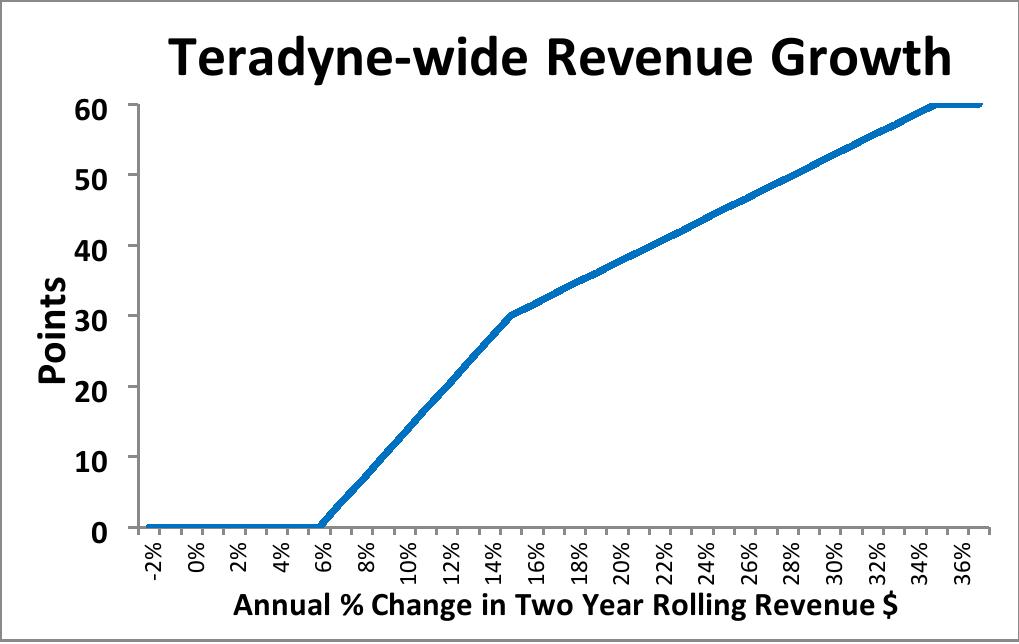

The Company’s performance-based variable compensation for 2017 was tied to the Company’s rate of profitability, revenue growth and the achievement of strategic business objectives, including market share gains, revenue and bookings goals, profit and gross margin targets, strategic customer wins and new product launches – the achievement of which positively impact the Company’s long-term performance. In 2016, after multiple years of achieving profitability goals at sustained revenue levels, the Company added a two-year rolling revenue growth rate metric as an element of the variable cash compensation plan to reinforce the importance of achieving short- and long-term revenue growth as well as achieving its profitability goals. Due to the Company’s rate of profitability, revenue growth and achievement of market share and other strategic goals in 2017, executive officers received variable cash compensation payouts ranging from 158% to 181% of target.

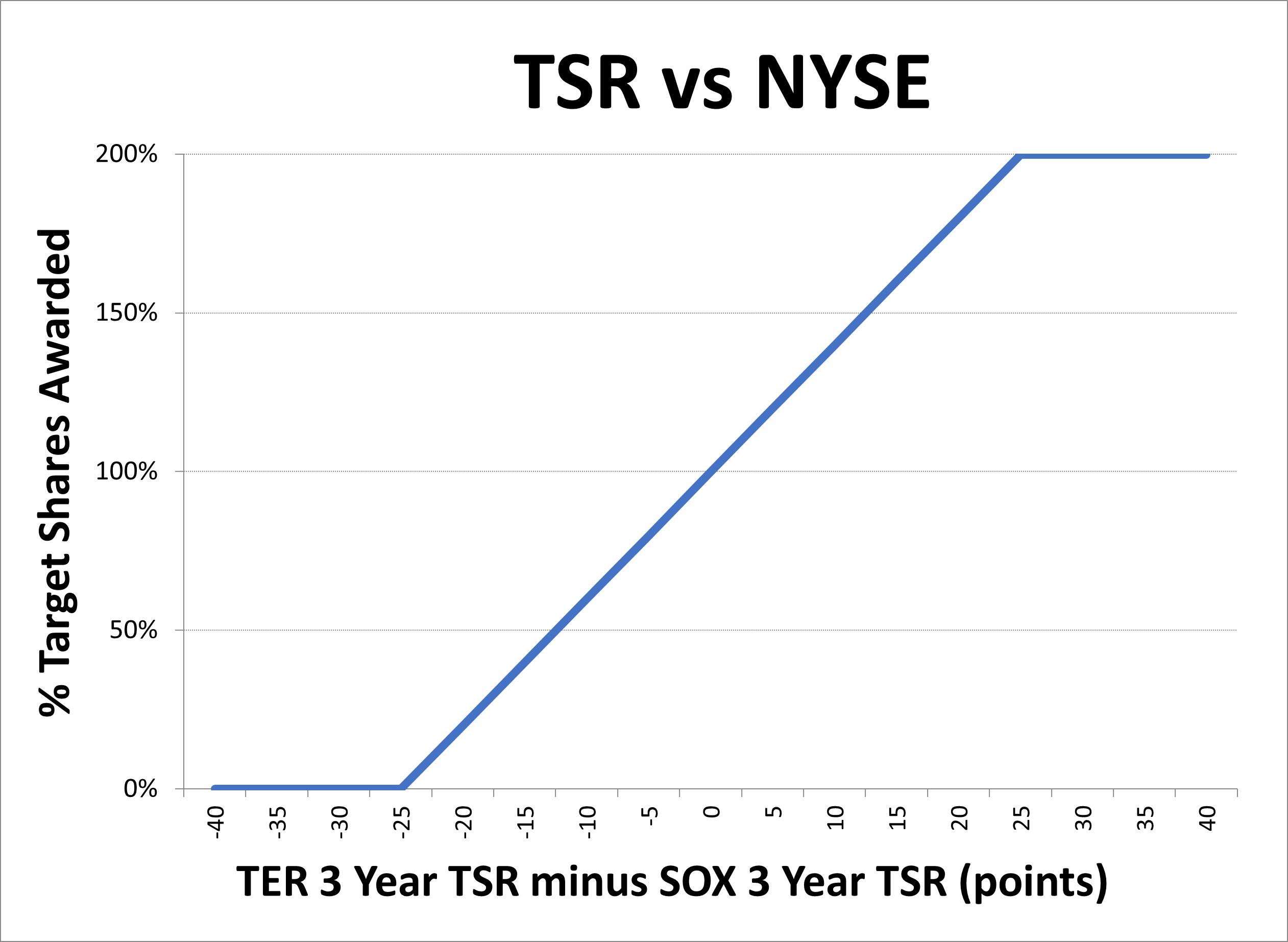

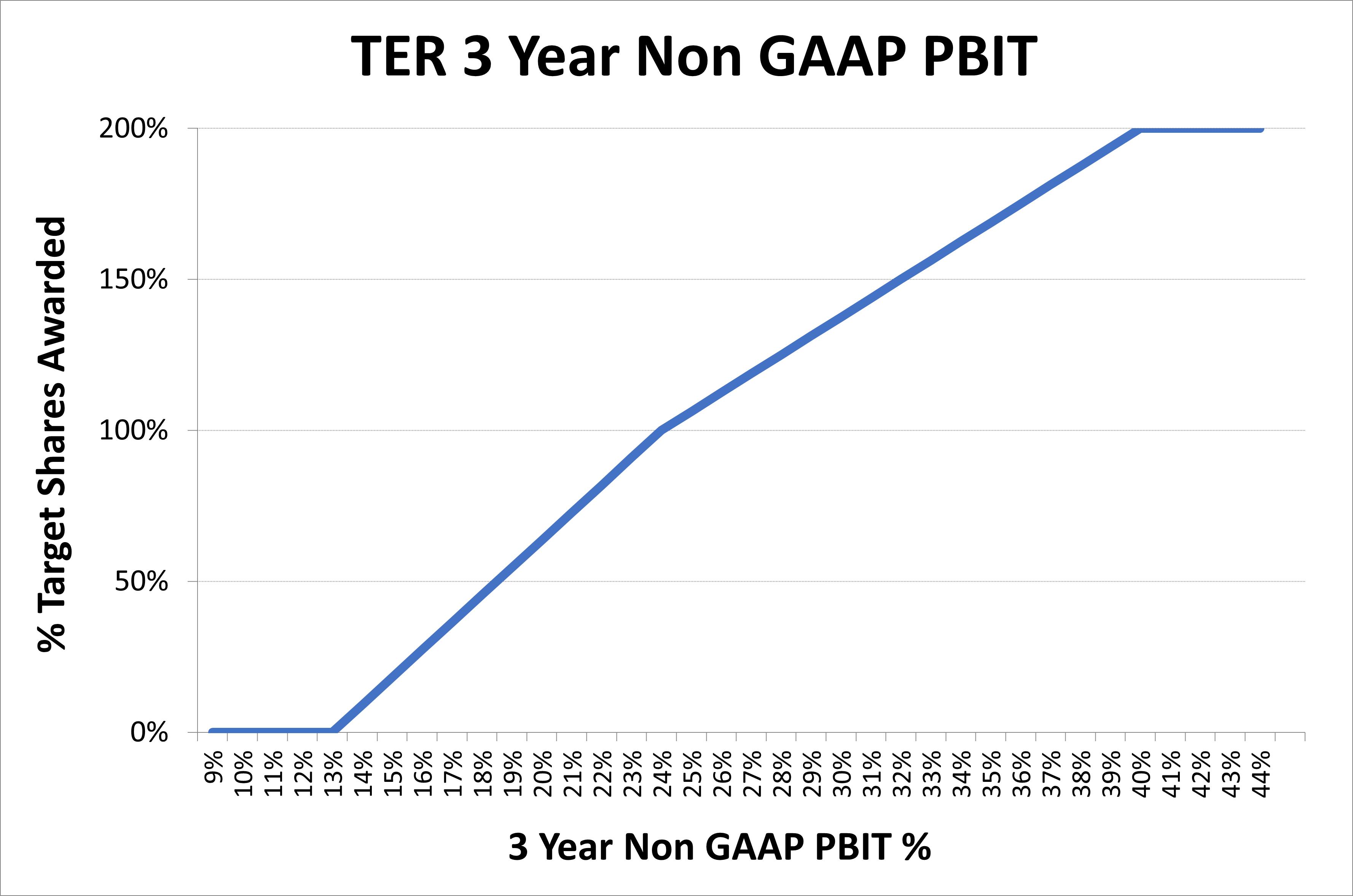

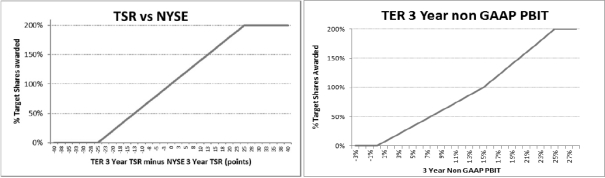

In 2017, the Company’s long-term performance criteria for performance-based stock awards included both the prior relative total shareholder return component and a new cumulative PBIT component, each measured at the end of a three-year performance period, consistent with the Company’s long-term goal to deliver profitability and superior return to shareholders. The determination of the final number of shares to be received for these performance-based stock awards will not be determined until January 2020.

In January 2018, the executive officers achieved 154.5% of their target performance-based stock awards granted in 2015 based on Teradyne’s relative total shareholder return performance measured against the Philadelphia Semiconductor Index during the three-year performance period from January 2015 to January 2018.

The Company’s shareholders voted to approve the Say-on-Pay advisory proposal at the 2017 Annual Meeting of Shareholders with 93% of the votes cast approving the proposal. Notwithstanding this result, the Board of Directors continues to assess the Company’s executive compensation program to ensure it remains aligned with both short-term and long-term performance. For example, in 2018, the Company increased the PBIT rate target for variable cash compensation from 15% to 17% and increased the percentage PBIT required for maximum variable cash compensation payout from 25% to 30% and similarly increased the three-year cumulative PBIT rate component of the long term performance criteria for performance-based stock awards from 15% to 17% and increased the percentage PBIT required for maximum vesting of PBIT determined performance-based stock awards from 25% to 30%.

The performance-based variable cash compensation and equity awards are described in detail in the “Compensation Discussion and Analysis” section of this proxy statement.

The Company will report the results of the “Say-on-Pay” vote in a Form 8-K following the 2018 Annual Meeting of Shareholders.Meeting. The Company also will disclose in subsequent proxy statements how the Company’s compensation policies and decisions take into account the results of the shareholder advisory vote on executive compensation.

The Board recommends a vote FOR the advisory resolution approving the compensation of the Company’s named executive officers as described in this proxy statement.

PROPOSAL NO. 3

AMENDMENT TO THE ARTICLES OF ORGANIZATION TO LOWER THE VOTING REQUIREMENT FOR APPROVAL OF AN AMENDMENT OF THE ARTICLES OF ORGANIZATION AND FOR APPROVAL OF A VOLUNTARY DISSOLUTION OF THE COMPANY FROM A SUPER-MAJORITY TO A SIMPLE-MAJORITY

Section 10.03 of the Massachusetts Business Corporation Act requires the affirmative vote of at least two-thirds of the outstanding shares of the corporation entitled to vote on a matter in order to approve an amendment to the corporation’s articles of organization, unless the articles of organization provide for a lesser percentage. In addition, Section 14.02 of the Massachusetts Business Corporation Act requires the affirmative vote of at least two-thirds of the outstanding shares of the corporation entitled to vote on a matter in order to approve a voluntary dissolution of a corporation, unless the articles of organization provide for a lesser percentage. Because the Company’s Restated Articles of Organization (the “Articles”) do not provide for a lesser percentage, an amendment to the Articles or a voluntary dissolution of the Company must be approved by at least two-thirds of the Company’s outstanding shares entitled to vote on such matter.

Our Board is committed to high standards of corporate governance for the Company and its shareholders. The Board considered the advantages and disadvantages of the current “two-thirds of the outstanding shares” voting standard to amend the Articles or approve a voluntary dissolution. The Board believes that this proposal is consistent with our continuing commitment to best practices in corporate governance, including growing sentiment that the elimination of such a provision provides shareholders greater ability to participate in the corporate governance of the Company.

After careful consideration, on January 22, 2024, the Board unanimously approved, and recommends that the Company’s shareholders approve, an amendment to the Company’s Articles to add Article VI.D to the Articles, which provides that an amendment to the Articles may be approved by the affirmative vote of holders of a majority in interest of all stock issued, outstanding and entitled to vote on such matter and to add Article VI.E to the Articles, which provides that approval of a voluntary dissolution of the Company shall require the affirmative vote of holders of a majority in interest of all stock issued, outstanding and entitled to vote on such matter. The Board determined that this amendment to the Articles was in the best interests of the Company and its shareholders and directed this amendment to the Articles to be submitted to the shareholders for approval at the Annual Meeting.

If this amendment to the Articles is approved, as of the filing of the Restated Articles (defined below), the Company’s articles of organization and bylaws will not contain any supermajority voting requirements and, except for certain matters that, in accordance with the Massachusetts Business Corporation Act, require the affirmative vote of holders of a majority in interest of all stock issued, outstanding and entitled to vote on such matter, which matters will be set forth in Articles VI.B, VI.D and VI.E of the Restated Articles, all matters shall require the affirmative vote of the holders of a majority of the stock present or represented and voting on a matter or, in the case of a contested director election, a plurality of votes cast for directors. If this amendment to the Articles is approved, the affirmative vote of holders of a majority in interest of all stock issued, outstanding and entitled to vote on the matters set forth in Articles VI.B, VI.D and VI.E of the Restated Articles will be the closest voting standard to a requirement of an affirmative vote of a majority of votes cast that is permitted under the Massachusetts Business Corporation Act with respect to such matters.

Restated Articles of Organization

If approved, this amendment to the Articles would become effective upon filing of Restated Articles of Organization (the “Restated Articles”) with the Secretary of the Commonwealth of Massachusetts, the form of which is attached hereto as Appendix B, which, subject to shareholder approval, the Company intends to file promptly after the Annual Meeting.

Vote Required

The affirmative vote of the holders of at least two-thirds of shares outstanding and entitled to vote on this matter as of the Record Date is required for the approval of this proposal. Abstentions and “broker non-votes” will have the same effect as voting “against” the proposal.

The Board recommends a vote FOR the approval of the amendment to the Articles to lower the voting requirement for approval of an amendment to the Articles and approval of a voluntary dissolution of the Company from a super-majority to a simple-majority.

PROPOSAL NO. 4

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected (and the Board of Directors has approved) PricewaterhouseCoopers LLP to serve as Teradyne’s independent registered public accounting firm for the fiscal year ending December 31, 2018.2024. PricewaterhouseCoopers LLP, or its predecessor Coopers & Lybrand L.L.P., has served as Teradyne’s independent registered public accounting firm since 1968. The appointment of PricewaterhouseCoopers LLP is in the best interest of Teradyne’s shareholders. Teradyne expects that a representative from PricewaterhouseCoopers LLP will be at the annual meeting, will have the opportunity to make a statement if so desired and will be available to respond to appropriate questions. The ratification of this selection is not required by the laws of Thethe Commonwealth of Massachusetts, where Teradyne is incorporated, but the results of this vote will be considered by the Audit Committee in selecting an independent registered public accounting firm for future fiscal years.

The Board recommends a vote FOR ratification of the selection of PricewaterhouseCoopers LLP.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Corporate Governance and Board Policies

Teradyne is committed to good, transparent corporate governance to ensure that the Company is managed for the long-term benefit of its shareholders. TheTeradyne’s Board of Directors (the “Board”) has adopted Corporate Governance Guidelines (“Guidelines”) to provide a framework for the effective governance of Teradyne. The Nominating and Corporate Governance Committee periodically reviews the Guidelines and recommends changes, as appropriate, to the Board of Directors for approval. The Board of Directors has also adopted written charters for its standing committees (Audit, Compensation, and Nominating and Corporate Governance), and the Company has a Code of Conduct applicable to all directors, officers and employees. Copies of the Guidelines, committee charters, and Code of Conduct are available on the Company’s web sitewebsite atwww.teradyne.com under the “Corporate Governance”“Governance” section of the “Investors”“Investor Relations” link. Teradyne posts additional information on its web sitewebsite from time to time as the Board makes changes to Teradyne’s corporate governance policies.

Teradyne has instituted a variety of policies and practices to foster and maintain good corporate governance. The Board reviews these practices on a regular basis. Teradyne’s current policies and practices include the following:

•

Independent directors constitute a majority of the Board and all members of the Board Committees;

•

Independent Board Chair;

•

All directors elected annually for a one-year term with majority voting for uncontested Board elections;

•

Adoption of “Poison Pill” requires shareholder approval;

•

Recoupment of incentive compensation from executives for fraud resulting in financial restatement;

Director•

Robust director and executive officer stock ownership guidelines;

•

Insider Trading Policy and Rule 10b5-1 Policy reflecting new SEC regulations;

•Policy prohibiting employees, executives and directors from hedging Teradyne stock and pledging Teradyne stock as collateral for loans;

•Annual Board and Committee self-assessments;

•

Executive sessions of independent directors at Board meetings;

•

Board access to management and independent advisors;

•

Board oversight of enterprise risk management, including cybersecurity and data protection risks;

•Independent registered public accounting firm and internal auditor meet regularly with Audit Committee without management present;

Review by•

An environmental, social and governance (“ESG”) program and Corporate Social Responsibility (“CSR”) Report;

•Board oversight of the Company’s ESG program and review of its CSR Report;

•Regular Nominating and Corporate Governance Committee review of Board composition, skills, diversity and refreshment and succession plan;

•Nominating and Corporate Governance Committee review of director’s change in position;

•

Annual Board review of executive succession plan;

•No director may serve on more than four other public company boards;

•Directors must be 74 years or younger as of the date of their election or appointment – this requirement has no exceptions or conditions;

•Directors may be removed by a shareholder vote with or without cause;

•Annual review of non-employee director compensation and cap on the aggregate value of total annual compensation to non-employee directors;

•Annual Board evaluation of Chief Executive Officer performance; and

•Policy promoting equal opportunity for all employees, including gender pay equity.

Policy prohibiting executives and directors from hedging Teradyne stock (through short selling or the use of financial instruments such as exchange funds, equity swaps, puts, calls, collars or other derivative instruments) and pledging Teradyne stock as collateral for loans (including through the use of margin accounts).

Board Nomination Policies and Procedures

The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending candidates for election to the Board and does not distinguish between nominees recommended by shareholders and other nominees. All nominees must meet, at a minimum, the Board membership criteria described below.

Director nominees are evaluated on the basis of a range of criteria, including (but not limited to): integrity, honesty and adherence to high ethical standards; business acumen, experience and ability to exercise sound judgments and contribute positively to a decision-making process; commitment to understanding Teradyne and its industry, andindustry; commitment to regularly attend and participate in Board and Committee meetings; ability to ensure that outside commitments do not materially interfere with duties as a Board member; absence of a conflict of interest or

appearance of a conflict of interest; and other appropriate considerations.

Nominees shall be 74 years or younger as of the date of election or appointment. This requirement has no exceptions or conditions. No director may serve on more than four other public company boards.

The Board seeks nominees with a broad diversity of viewpoints, professional experience, education, geographic representation, backgrounds and skills. The backgrounds and qualifications of directors, considered as a group, should provide a significant composite mix of backgrounds, expertise and experience that will allow the Board to fulfill its responsibilities. The Board values racial, ethnic, cultural, gender, economic, professional and educational diversity in evaluating new candidates and seeks to incorporate a wide range of those attributes in Teradyne’s Board of Directors. Board composition isand succession planning are reviewed regularly to ensure that Teradyne’s directors reflect the knowledge, experience, skills and diversity required for the needs of the Board.

At the 2018 Annual Meeting, shareholders will be asked to consider the election of Marilyn Matz,Bridget van Kralingen, who has been nominated for election as director for the first time. In July 2017,January 2024, Ms. Matzvan Kralingen was appointed by our Board as a new director. Ms. Matzvan Kralingen was originally proposed to the Nominating and Corporate Governance Committee as a potential candidate for the Board by current Board member Edwin J. Gillis.an international executive and board search firm.

Shareholders wishing to suggest candidates to the Nominating and Corporate Governance Committee for consideration as potential director nominees may do so by submitting the candidate’s name, experience, and other relevant information to the Nominating and Corporate Governance Committee, 600 Riverpark Drive, North Reading, MA 01864. Shareholders wishing to nominate directors may do so by submitting a written notice to the Secretary at the same address in accordance with the nomination procedures set forth in Teradyne’s bylaws. Additional information regarding the nomination procedure is provided in the section below captioned “Shareholder Proposals for 20192025 Annual Meeting of Shareholders”.Shareholders.”

Director Independence

Teradyne’s Corporate Governance Guidelines require that at least a majority of the Board shall be independent.independent and set out standards for determining director independence. To be considered independent, a director must satisfy the definitions pursuant to the SEC rules and the listing standards of the New YorkThe Nasdaq Stock ExchangeMarket LLC (“NYSE”Nasdaq”), meet the standards regarding director independence adopted by Teradyne, and, in the Board’s judgment, not have a material relationship with Teradyne. The standards for determining independenceTeradyne’s Guidelines are available on Teradyne’s web sitewebsite atwww.teradyne.com under the “Corporate Governance”“Governance” section of the “Investors”“Investor Relations” link.

The Board has determined that the following directors are independent using the criteria identified above: Michael A. Bradley, Daniel W. Christman, Edwin J. Gillis, Timothy E. Guertin, Peter Herweck, Mercedes Johnson, Ernest E. Maddock, Marilyn Matz, Ford Tamer, Paul J. Tufano, and Roy A. Vallee.Bridget van Kralingen. In determining the independence of Teradyne’s directors, the Board reviewed and determined that the following did not preclude a determination of independence under Teradyne’s standards: Mr. Herweck’s position as CEO of Schneider Electric, a Teradyne customer; Ms. Johnson’s position as a director of Micron Technology,Analog Devices, Inc., Juniper Networks, Inc., and, until its acquisition by Renesas Electronics Corporation in February 2017, Intersil Corporation, eachboth a Teradyne customer; Mr. Tufano’s position as President, Chief Executive Officersupplier and director of Benchmark Electronics, Inc., one of Teradyne’s customers; and each of Ms. Johnson’s and Mr. Vallee’s positioncustomer, as a director of Synopsys, Inc., oneboth a Teradyne customer and supplier; Mr. Maddock’s position as director of Teradyne’s suppliers.Avnet, Inc., both a Teradyne customer and supplier; and Mr. Tamer’s position as a director of Marvell Technology, Inc., a Teradyne customer. Teradyne’s business with Micron Technology, Intersil, Juniper Networks, Benchmark ElectronicsAnalog Devices, Synopsys, Avnet, Schneider and SynopsysMarvell during 20172023 was immaterial to Teradyne and to the other companies. Teradyne will continue to monitor its business relationships and any significant competitive activity to ensure they have no impact on the independence of its directors. The Board has determined that Michael A. Bradley met the standards for independence on February 1, 2018 because, as of that date, he had not received compensation from Teradyne related to his employment as the Company’s Chief Executive Officer during a twelve-month period within the last three years. The Board has determined that Mark E. JagielaGreg Smith is not independent because he is Teradyne’s Chief Executive Officer.

All members of the Company’s three standing committees – the Audit, Compensation, and Nominating and Corporate Governance Committee – are required to be independent and have been determined by the Board to be independent pursuant to the SEC rules and the listing standards of the NYSE,Nasdaq, as well as Teradyne’s standards.

The independent directors of the Board and its standing committees periodically meet without management present.

Board Leadership Structure and Self-Assessment

Since May 2014,2021, Mr. ValleeTufano has served as an independent Chair of the Board. The Board believes that having an independent Chair is the preferred corporate governance structure for the Company because it strikes an effective balance between management and independent leadership participation in the Board process.

The Board and each of its committees annually undertake a self-assessment, including an evaluation of its composition, mandate and function. The Chair of the Nominating and Corporate Governance Committee manages this annual process and implementation of any action items resulting from the process. For example, as a result of one of the Board’s self-assessments in which the directors expressed their interest in having a separate strategy discussion, an annual strategic session with management was implemented starting in 2018. Additionally, based on the result of another self-assessment, the board undertook a multi-year refreshment and succession planning process beginning in 2020.

Code of Ethics

The Code of Conduct is Teradyne’s ethics policy. The Company deploys Code of Conduct training to all new full and part time employees and contractors as part of the on-boarding process and administers annual Code of Conduct refresher training to all employees at the end of each year, which includes a video presentation, quiz and compliance certification. The Code of Conduct training covers a variety of topics, including anti-corruption and bribery, proper workplace conduct, diversity, equity and inclusion, unconscious bias, avoiding conflicts of interest, cybersecurity and information security and protection in the workplace, environmental best practices in the workplace, health and safety practices, and proper use of social media. The Board has established a means for anyone to report violations of the ethics policy on a confidential or anonymous basis. Teradyne’s Code of Conduct is available on Teradyne’s web sitewebsite atwww.teradyne.com under the “Corporate Governance”“Governance” section of the “Investors”“Investor Relations” link.

Teradyne maintains an insider trading policy as part of its Code of Conduct. Among other things, the insider trading policy prohibits trading on material non-public information and provides that directors, executive officers and certain other employees are prohibited from buying or selling Teradyne securities during the Company’s non-trading periods, also called “blackout periods”, except pursuant to an approved trading plan.

Teradyne shall disclose any changesubstantive amendments to or waiver, including an implicit waiver, from the Code of Conduct granted to an executive officer or director within four business days of such determination by disclosing the required information on its web sitewebsite at www.teradyne.com under the “Governance” section of the “Investor Relations” link or in a Current Report on Form 8-K..

Insider Trading Policy

The Board has adopted an insider trading policy (“Insider Trading Policy”) to prevent the misuse of confidential information about Teradyne as well as other companies with which the Company has a business relationship and to promote compliance with the securities laws. Among other things, the Insider Trading Policy prohibits trading on material non-public information and prohibits directors, executive officers and certain other

employees from buying or selling Teradyne securities during the Company’s non-trading periods, also called “blackout periods”, except pursuant to an approved trading plan under Rule 10b5-1 of the Securities Exchange Act of 1934 (“Rule 10b5-1”). The Board has also adopted a Rule 10b5-1 plan policy (“Rule 10b5-1 Plan Policy”) which applies to all executive officers and directors of Teradyne who adopt Rule 10b5-1 plans for trading in Teradyne’s securities. The Rule 10b5-1 Plan Policy sets forth mandatory guidelines that are intended to ensure compliance with Rule 10b5-1, including amendments adopted by the SEC in 2023, and to conform to best practices with respect to the design and implementation of Rule 10b5-1 plans.

Hedging and Pledging Policy

The Board recognizes there may be an appearance of improper or inappropriate conduct if Teradyne’s employees, executives and directors engage in certain types of transactions, even in circumstances where they may not be aware of any material, nonpublic information. Therefore, the Board has adopted, through the insider trading policy, a policy prohibiting employees, executives and directors from hedging Teradyne stock through short sales, prepaid variable forward contracts, equity swaps, collars and exchange funds. In addition, transactions in put options, call options or other derivative securities, on an exchange or in any other organized market, are prohibited by this policy. The policy also prohibits holding Teradyne securities in a margin account or pledging Teradyne securities as collateral for loans.

Environmental, Social and Governance

The Board is committed to promoting, creating and maintaining a safe and healthy workplace, environment and society. Teradyne is committed to employee health, safety and welfare, to managing its activities that impact the environment in a responsible and effective manner, and to supporting the communities where its employees live and work. Teradyne strives to drive improvements in environmental sustainability, supply chain responsibility, diversity and inclusion, and positive social impact. In 2019, Teradyne formalized its ESG program and published its first CSR report. In August 2019, the Board invited an outside expert to present to the full Board on best practices and trends in ESG programs. Throughout 2020, 2021, 2022, and 2023 the Company expanded its ESG program and, in November 2023, published its fifth CSR report. In 2021, the Company became a member of The Responsible Business Alliance (“RBA”) and is continuing to implement many of the best practices of the RBA, including relating to compliance of the Company’s supply chain with its ESG program. In 2022, the Company joined the SEMI Climate Consortium, a semiconductor equipment industry group focused on reducing the greenhouse gas emissions in the production and operation of chip making equipment. In December 2023, the Company submitted a letter of commitment with the Science Based Target initiative establishing the Company's intent to set a science-based target.

The 2021, 2022 and 2023 CSR reports substantially expanded disclosure related to ESG, and the Company plans to continue to enhance its program and to provide additional, detailed disclosures to its shareholders, employees, customers, suppliers and other stakeholders. As described in the Code of Ethics section above, Teradyne’s annual Code of Conduct training includes training for employees on diversity and unconscious bias as well as on environmental best practices, including power and water conservation, recycling, and encouraging innovative designs to reduce energy consumption of the Company’s products.

Teradyne’s Board oversees its ESG program to ensure ESG initiatives are linked to company-wide strategic planning decisions. The Nominating and Corporate Governance Committee has primary responsibility for overseeing ESG priorities and the successful implementation of these priorities. The Company’s other Board committees also have oversight responsibility for ESG topics under their purview. Management annually reviews the Company’s ESG program and CSR report with the Board and regularly provides updates to the Board and Board committees and engages them to discuss ESG strategy, gain alignment on goals, and report on progress. The Company’s cross-functional ESG steering team is responsible for developing and executing its ESG strategy, proposing goals, approving and supporting initiatives, and embedding ESG into the corporate culture. The ESG steering team reports to Teradyne’s CEO and CFO. In addition, the Company has topic-specific working teams to address key ESG initiatives and a dedicated ESG manager who reports to the ESG steering team and drives these initiatives.

Detailed information regarding Teradyne’s ESG activities is available on its website at https://www.teradyne.com under the “Corporate Governance” sectionSocial Responsibility” link.

Human Capital Resources

The Board oversees the establishment and the maintenance of the “Investors” link.Company’s core values and its management of human capital. The Board believes that the Company’s future success depends upon its continued ability to attract, develop, and retain a high-performance workforce, comprised of people with shared values.

Corporate Culture

Teradyne’s core values are conducting business with honesty and integrity, collaborating with colleagues as a company without doors, and partnering with customers every step of the way because customers count on us. The Company is committed to conducting business in a responsible manner, with strategic operational policies, procedures and values that support transparency, sustainability and legal compliance. Teradyne ensures its employees ethically operate and fulfill business commitments through robust monitoring of the Company’s Code of Conduct and environmental, health and safety programs. The Company strives to foster a positive work environment that helps employees thrive. It is a priority for Teradyne to ensure that its people feel inspired, supported, safe and able to achieve their personal best. The Company is committed to equality as evidenced by its nondiscrimination, harassment prevention and pay equity policies and training. Teradyne values a diverse, inclusive and respectful work environment where all employees enjoy challenging assignments and development opportunities within the framework of a safe, positive culture.

Competitive Pay and Benefits

The primary objective of Teradyne’s compensation program for employees generally is to provide a compensation and benefits package that will continue to attract, retain, motivate and reward high performing employees who operate in a highly competitive and technologically challenging environment. The Company seeks to achieve this objective by linking a meaningful portion of compensation to Company and business unit performance. Teradyne enables employees to share in the success of the Company through various programs, including an employee stock purchase program, equity compensation and profit sharing and bonus plans. The Company seeks to provide competitive and fair total compensation and, to do so, refers to peer comparisons and internal equity. In addition to providing employees with competitive compensation packages, Teradyne offers benefits designed to meet the needs of employees and their families, including paid time off, parental leave, bereavement leave, health insurance coverage, flexible work arrangements, contributions to retirement savings, and access to employee assistance and work-life programs.

Employee Development and Training

Teradyne believes that employee development and training is a key factor in continuing to attract, motivate, develop and retain a strong, competitive workforce. The Company provides continual development opportunities to its employees, with a focus on development of job skills and competencies. Examples include new manager competencies like giving feedback and coaching, and training in software development tools and project management. Teradyne’s employees also receive annual performance reviews and are involved in setting goals for their own development and performance. Employees and managers look back on the previous year, review career development plans and create goals for the next year. In 2022, Teradyne implemented a new learning management system integrated with its human resources system. This enabled the business to more easily create and offer business training courses, including on topics such as project management, electrical safety, engineering standards, and product and sales. Additionally, for the first time, in 2023 Teradyne hired a Learning Development Manager to enhance the delivery of employee training programs throughout the Company.

Teradyne is committed to recruiting and developing talent at the collegiate level to help advance Science, Technology, Engineering and Mathematics (“STEM”) education for the future generation. For example, the Company’s paid internships and entry-level positions offer real-world experience, and its paid co-op program offers higher education students a unique learning opportunity as students alternate one semester in a work assignment and

one semester in the classroom. Additionally, Teradyne offers reimbursement for educational courses related to an employee’s work or as part of a degree program, including tuition, lab fees and books. The Company also offers a scholarship program for employees with college-age children and grandchildren. In 2023, approximately half of the scholarship recipients were outside of the United States.

Employee Engagement

Teradyne conducts regular employee surveys to check in with its global workforce and obtain input on a number of topics. The feedback received from these surveys helps management assess employee sentiment and identify areas of improvement and guides decision-making as it relates to people management. In addition, the Company’s CEO, other executives and individual directors meet with employees on a frequent basis through exchange meetings and quarterly webcasts. The exchange meetings allow the executives and directors to directly interact with a small group of employees, while the global webcasts enable all employees to engage with senior leaders and ask questions in an open Q&A session.

Diversity and Inclusion; Community Engagement

Teradyne believes in fostering a diverse workforce and equitable and inclusive culture in order to build a stronger and more resilient company for our customers, our investors, our employees and our communities worldwide. To support this effort, Teradyne has a Diversity and Inclusion Charter, which was developed by the Company’s Diversity, Equity and Inclusion (“DEI”) executive sub-committee and designed to ensure that the Company builds diversity across our workforce. Since 2021, Teradyne has had a DEI program manager to steer its DEI efforts and maintain an internal DEI website for employees. The Company has programs for recruiting and hiring candidates from various backgrounds and experiences. Teradyne also has policies regarding gender pay equity and regularly conducts audits of pay equity in the United States. It conducts mandatory DEI-related training for employees worldwide and offers a wide variety of optional DEI-related training courses as well. Teradyne is an equal opportunity and affirmative action employer committed to making employment decisions without regard to race, religion, ethnicity or national origin, gender, sexual orientation, gender identity or expression, age, disability, protected veteran status or any other characteristics protected by law.

Teradyne has a tradition of amplifying the charitable actions of its employees and responding to the needs of the communities where we work. To make it easier for employees to support charitable activities and magnify the impact of support, the Company established a formal matching gift program, “Teradyne Gives.” This program matches up to $1,000 per year of an employee’s donations to charities of their choosing, selected from a wide range of qualified non-profit organizations.

Additionally, advancing education for future generations is a primary initiative at Teradyne. The Company seeks to increase the diversity of STEM graduates worldwide through our support of STEM programs at the middle, high school and collegiate level. Teradyne also donates test equipment and robots to colleges, universities, and vocational programs.

Health and Safety

The health and safety of its employees is the Company’s highest priority. Teradyne is committed to complying with all applicable health and safety regulations wherever it operates. The Company conducts internal audits and regular reviews and monitoring of regulations to ensure compliance with laws and regulations at the local, state, province and country levels. Teradyne ensures workers are provided with the knowledge to perform their jobs safely by deploying mandatory environment, health and safety training. The Company also requires contractors to complete safety training prior to working at any Teradyne site. The Company monitors, tracks and reports common safety metrics such as accidents, near misses and illness, and its injury and illness rate is below the industry average. Teradyne also provides its employees with a flexible and adjustable workspace, which includes reviewing ergonomics issues in the workplace, educating employees to self-identify risks and ensuring they have the work environment they need to do their jobs safely and effectively.

Board Oversight of Risk

Management is responsible for the day-to-day management of risks to the Company, while the Board, of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. Management attends regular Board and committee meetings and discusses with the Board and committees various risks confronting the Company, including operational, cybersecurity and information security, legal, geopolitical, market and competitive risks.risks as well as the risks to the Company, its business and its employees due to climate change and trade regulations. Management and the Board have not identified any risks arising from Teradyne’s compensation plans, policies and practices for the executives or employees that are reasonably likely to have a material adverse effect on the Company.

The Board also oversees management's processes for identifying and mitigating risks, including cybersecurity risks, to help align the Company's risk exposure with its strategic objectives. Senior leadership, including the Company's Chief Information Security Officer, briefs the Audit Committee quarterly, and the full Board at least annually, on the Company's cybersecurity and information security posture.

Related Party Transactions

Under Teradyne’s written “Conflict of Interest Policy,” which is part of Teradyne’s Code of Conduct, the General Counsel notifies the Audit Committee of any investment or other arrangement to be entered into by Teradyne that could or would be perceived to represent a conflict of interest with any of the executive officers or directors. Every year Teradyne makes an affirmative inquiry of each of the executive officers and directors as to their existing relationships. Teradyne reports any potential conflicts identified through these inquiries to the Audit Committee. No potential conflicts were identified in 2023.

Shareholder Communications with Board of Directors

Shareholders and other interested parties may communicate with one or more members of the Board, including the Chair, or the non-management directors as a group by writing to the Non-Management Directors, Board of Directors, 600 Riverpark Drive, North Reading, MA 01864 or by electronic mail at nonmanagementdirectors@teradyne.com. Any communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities, such as customer complaints, will be sent to the appropriate executive. Solicitations, junk mail, computer viruses, and obviouslyother similarly frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.

Under Teradyne’s Corporate Governance Guidelines, each director is expected to attend each annual meeting of shareholders. All then-serving directors attended the 20172023 Annual Meeting of Shareholders held on May 9, 2017.12, 2023.

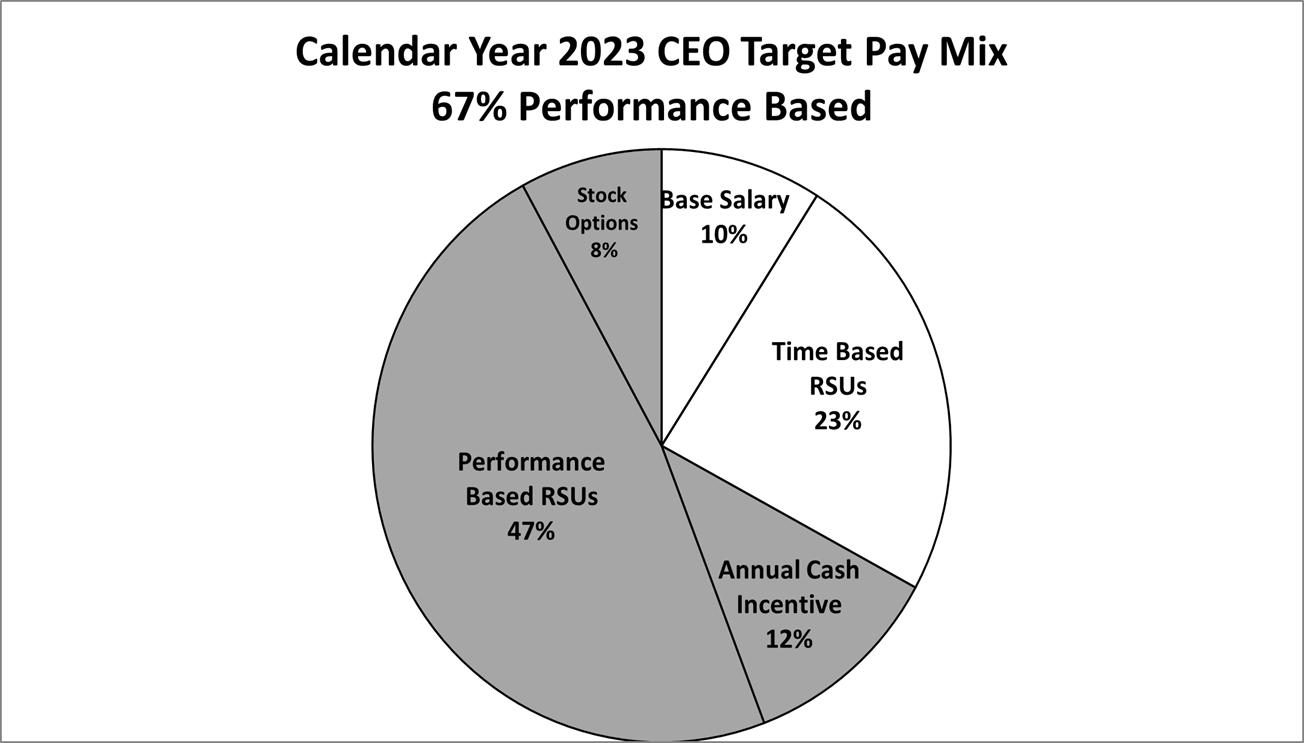

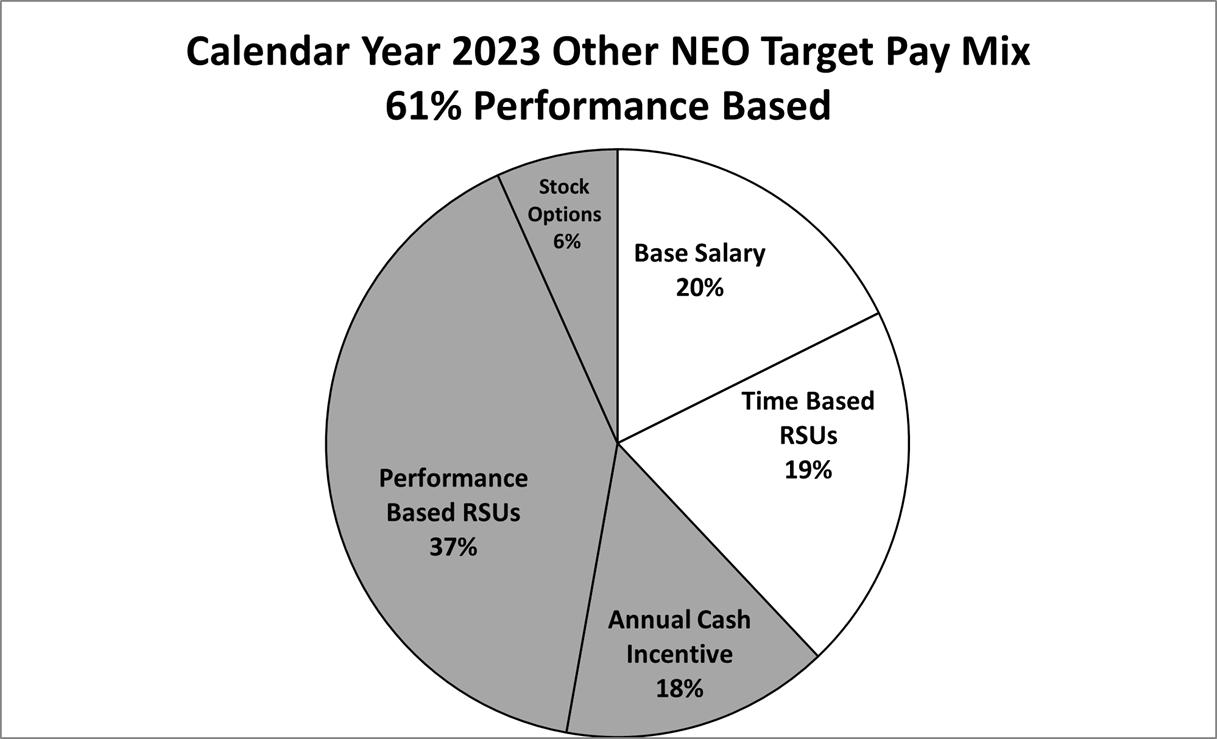

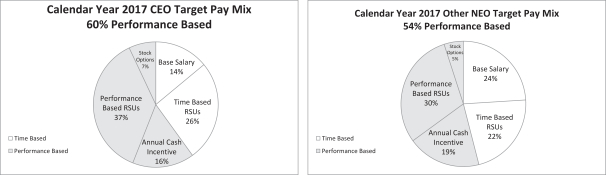

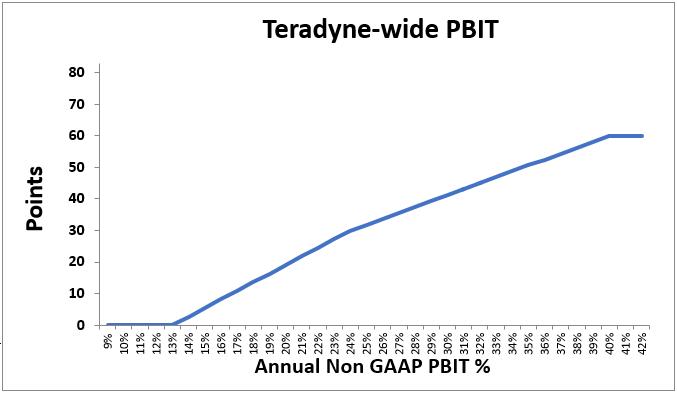

Board Meetings